MUMBAI: Retail stress is are expected to remain elevated in the Sept quarter, Yes Bank chief Prashant Kumar said. According to him, the stress is due to aggressive unsecured lending, which led to over-leveraging. However, he noted that lending has since slowed.

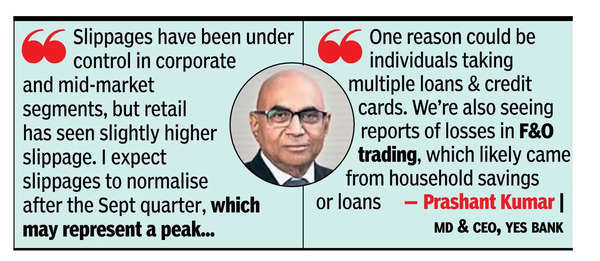

“Slippages have been under control in corporate and mid-market segments, but retail has seen slightly higher slippage.I expect slippages to normalise after the Sept quarter, which may represent a peak,” said Kumar.

He added, “One reason could be individuals taking multiple loans and credit cards. We’re also seeing reports of losses in F&O trading, which likely came from household savings or loans.”

In its first-quarter earnings call, Yes Bank acknowledged challenges in its unsecured lending portfolio and said it has implemented policy changes for cards and loans, pulling back in certain markets and profiles. The bank strengthened collections and will limit unsecured lending growth until confident in all segments.

Kumar explained one of the major drags on the bank’s profitability has been the money invested in RIDF (Rural Infrastructure Development Fund) to make up for the shortfall in mandatory rural obligations. By March 31, there was no shortfall which means no additional funds will need to be invested in RIDF going forward. Approximately 25% of the funds invested in RIDF, around Rs 11,000 crore out of a total of Rs 44,000 crore, will start coming back to the bank in the current financial year. The bank continued to be in the lookout for a microfinance company to acquire to meet its rural targets but was being careful on valuations and asset quality.

The bank has effectively controlled its cost of deposits so that has not increased as much as the market. To expand its deposit base the bank is expanding branch network by 40 this year and by 100 a year from FY26 onwards. “Our goal is to grow the deposits at higher rate than advances every year,” said Kumar.

Despite the retail challenges, Kumar said that growth opportunities existed in corporate, SME and mid-market segments and the bank was focused on improving cost-to-income ratio through productivity gains and better yielding assets. Yes Bank, which trans ferred its bad loans to JC Flowers Asset Reconstruction Company in lieu of security receipts has already redeemed half of the SRs following recoveries and was expecting to recover the remaining loans in two to three years.

Kumar said that the bank’s core equity is currently at 13.3%, which is quite a healthy level and means they do not need any additional capital for growth purposes in the current financial year. However, capital may be required to fund growth plans in the next financial year. While the bank has approval to raise up to Rs 2,500 crore in tier-2 capital.